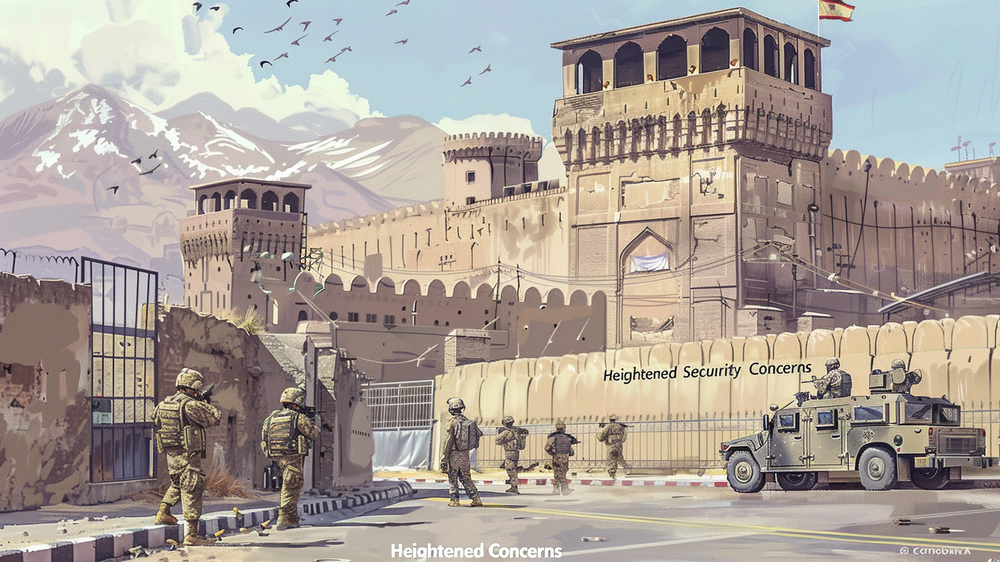

The recent military strike in Iran has had immediate economic repercussions, with oil prices surging and Dow futures dropping nearly 500 points. The instability triggered by reports of explosions in Iran has sent shockwaves through global markets, reflecting deep concerns over the potential for a prolonged conflict in the Middle East.

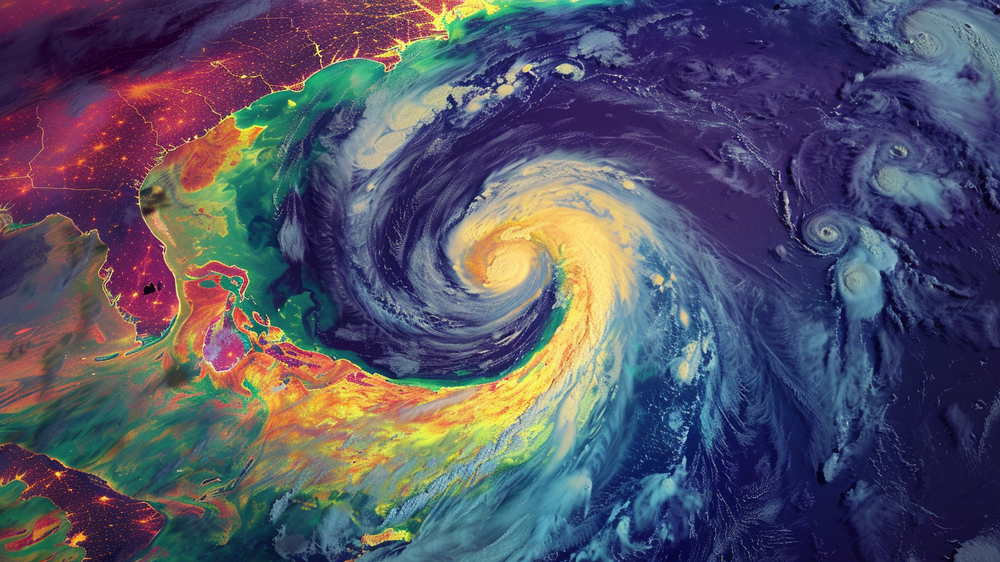

Investors are bracing for volatility as the situation could disrupt oil supplies from a region that is crucial to global energy markets. The surge in oil prices could lead to increased costs for consumers and businesses alike, potentially impacting economic recovery efforts worldwide post-pandemic.

Financial analysts are closely monitoring the developments, advising caution as the geopolitical situation remains fluid. Governments and energy companies may need to reassess their strategies to mitigate the impact of heightened tensions on global supply chains and economic stability.